What is Car Insurance?

Car insurance is essentially a legal contract between the policyholder and the insurance company, offering financial protection against accidents or theft. In India, it is mandatory under the Motor Vehicles Act, 1988 to have at least a third-party liability policy, and driving without valid insurance can result in strict legal penalties. While third-party insurance fulfills the basic requirement, a comprehensive car insurance policy provides wider coverage against accidents, theft, natural calamities, and even personal injuries.

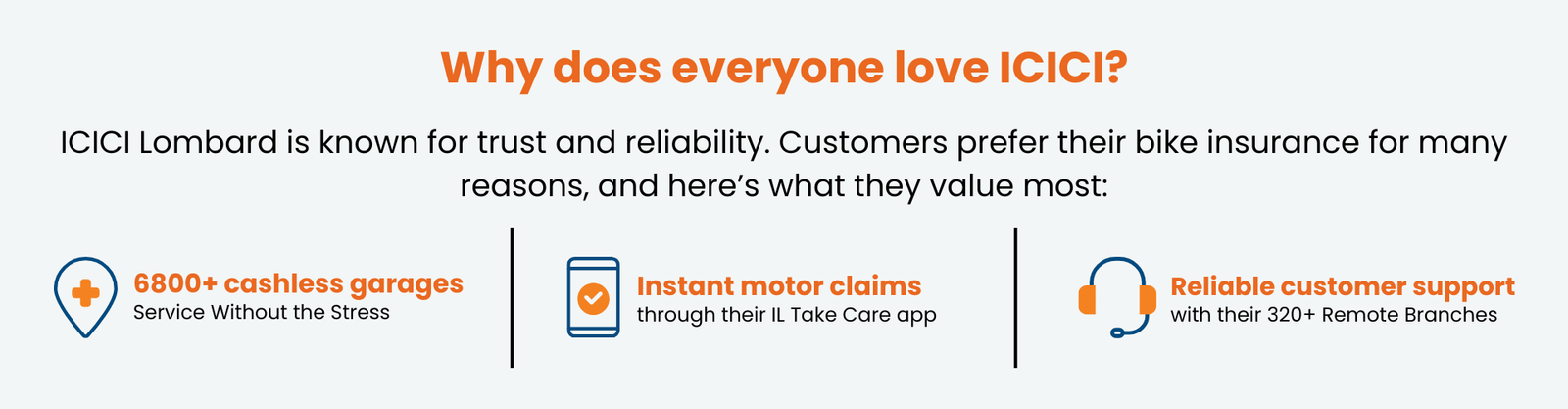

ICICI Lombard is known for offering car insurance policies starting at just ₹2,094 per year. With a strong network of 6,800+ cashless garages and a seamless claims process through the IL TakeCare app, the company ensures customers experience quick, convenient, and hassle-free support when they need it most.

ICICI Lombard Car Insurance

Smart insurance starts with ICICI Lombard, offering unmatched deals on car coverage

*T&C Apply

What is Bike Insurance?

Bike insurance is essential. Indian law requires every bike to have at least third-party coverage, with penalties up to ₹2,000 or three years’ imprisonment for non-compliance. Beyond legal protection, it covers repair or replacement costs from accidents, theft, or natural calamities, giving you financial security and peace of mind.

ICICI Lombard Bike Insurance

Smart insurance starts with ICICI Lombard, offering unmatched deals on bike coverage

*T&C Apply

2% Cashback on Scan and Pay transactions

2% Cashback on Scan and Pay transactions Age: 25-60 years

Age: 25-60 years ID Proof

ID Proof