IndusInd Credit Cards

Luxury, Rewards, Convenience – All-in-One!

×

Check your credit card eligibility

Apply smart. Avoid rejection.

Check eligibility in just 30 seconds.

Not sure if you’re eligible?

Check

🔍

Showing all cards

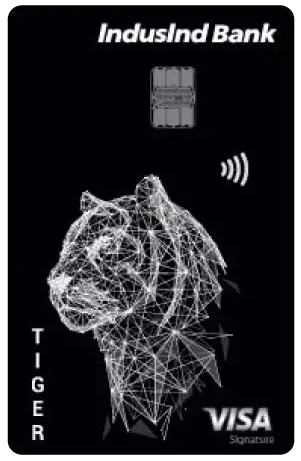

IndusInd Tiger Credit Card

Joining: ₹0

Annual: ₹0

- Earn 2 Reward Points per ₹100 on weekdays and 3 Reward Points per ₹100 on weekends for smarter everyday spending.

- Enjoy 2 domestic lounge visits per quarter, 2 international lounge visits annually via Priority Pass, plus complimentary golf games or lessons every quarter.

- Get 1 complimentary BookMyShow ticket worth up to ₹500 every 6 months and enjoy a low 1.5% forex markup on international spends.

×

Eligibility

Documents Required

Fees

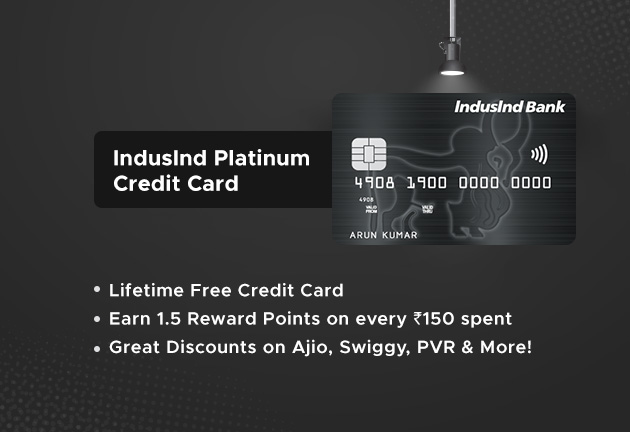

IndusInd Platinum Credit Card

Joining: ₹0

Annual: ₹0

- Earn 1.5 Reward Points on every ₹150 spent (₹0.65 value per point), and redeem for airline miles (including Vistara), cash credit, or instant bill payment.

- Get Total Protect cover up to your full credit limit, safeguarding you against unauthorised transactions, card loss/theft & counterfeit fraud.

- Enjoy fuel surcharge waiver at all petrol pumps, complimentary ICICI Lombard Travel Insurance, and exclusive discounts on AJIO, Swiggy, PVR, Lifestyle, boAt, BigBasket, Titan, Reliance & more.

×

Eligibility

Documents Required

Fees

IndusInd Platinum Aura Edge Credit Card

Joining: ₹0

Annual: ₹0

- Earn up to 4X Saving Points with flexible reward plans (Shop, Travel, Home & Party), plus fuel surcharge waiver and complimentary travel & air accident insurance for complete peace of mind.

- Unlock premium lifestyle privileges with exclusive discounts on AJIO, Swiggy, PVR, Lifestyle, EaseMyTrip, EazyDiner, Titan, Reliance & more—save more on shopping, dining, movies & travel.

- Enjoy added protection & value every day with ICICI Lombard Travel Insurance, personal air accident cover up to ₹25 lakh, and rewarding benefits on every spend across India.

×

Eligibility

Documents Required

Fees

IndusInd Legend Credit Card

Joining: ₹0

Annual: ₹0

- Get 1 Reward Point per ₹100 on weekdays and 2 Reward Points per ₹100 on weekends, plus 4,000 bonus Reward Points on annual spends of ₹6 lakh.

- Buy 1 Get 1 Free on BookMyShow (up to 3 free tickets every month), lowest forex markup of just 1.8%, and complimentary ICICI Lombard Travel Insurance.

- Instant discounts on Swiggy & EazyDiner, plus partner deals on boAt, BigBasket, PVR, Lifestyle, Titan, Reliance & more across shopping, dining and entertainment.

×

Eligibility

Documents Required

Fees

IndusInd Eazydiner Signature Credit Card

Joining: ₹1,999 + GST

Annual: ₹1,999 + GST

- Enjoy a 12-month complimentary EazyDiner Prime, 2,000 EazyPoints, ₹5,000 Postcard Hotel vouchers, and 8 free domestic lounge visits (2 per quarter).

- Get 2 complimentary BookMyShow tickets worth ₹200 each every month.

- Earn up to 10 Reward Points per ₹100 on dining, shopping & entertainment with EazyDiner Cards.

×

Eligibility

Documents Required

Fees

IndusInd Eazydiner Platinum Credit Card

Joining: ₹0 (Lifetime Free)

Annual: ₹0 (Lifetime Free)

- Earn up to 10 Reward Points per ₹100 on dining, shopping & entertainment.

- Get a 3-month EazyDiner Prime Membership, with renewal benefits on milestone spends.

- Earn 2,000 Reward Points + 3-month Prime renewal every time you spend ₹30,000 within 90 days.

×

Eligibility

Documents Required

Fees

IndusInd Platinum Rupay Credit Card

Joining: ₹0 (Lifetime Free)

Annual: ₹0 (Lifetime Free)

- Get 2 Reward Points per ₹100 on UPI transactions and 1 Reward Point per ₹100 on non-UPI spends, making everyday payments more rewarding.

- Enjoy a 1% fuel surcharge waiver at all petrol pumps in India on transactions between ₹400–₹4,000.

- Stay protected with travel insurance worth ₹2.25 lakh, including coverage for lost baggage, passport loss, trip delays, missed connections, and lost tickets.

×

2% Cashback on Scan and Pay transactions

2% Cashback on Scan and Pay transactions Age: 25-60 years

Age: 25-60 years ID Proof

ID Proof