Skip the paperwork and branch visits open your Digital Savings Account in just a few clicks, right from home. Start your banking journey today.

Smart, Paperless, And Rewarding Banking At Your Fingertips

Smart Banking With Higher Interest And Greater Convenience

Effortless Banking With Benefits That Grow With You

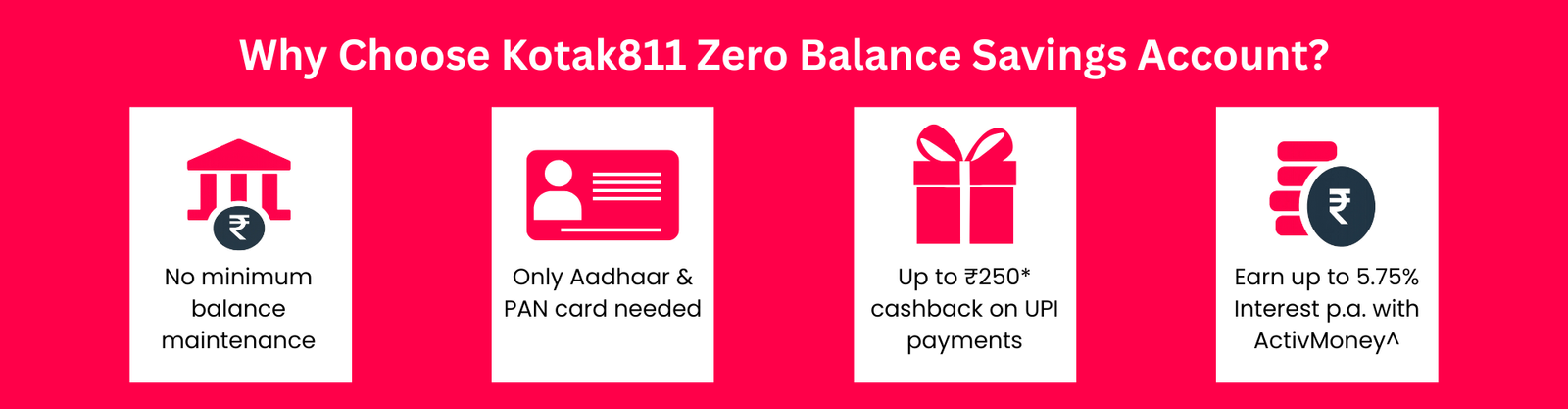

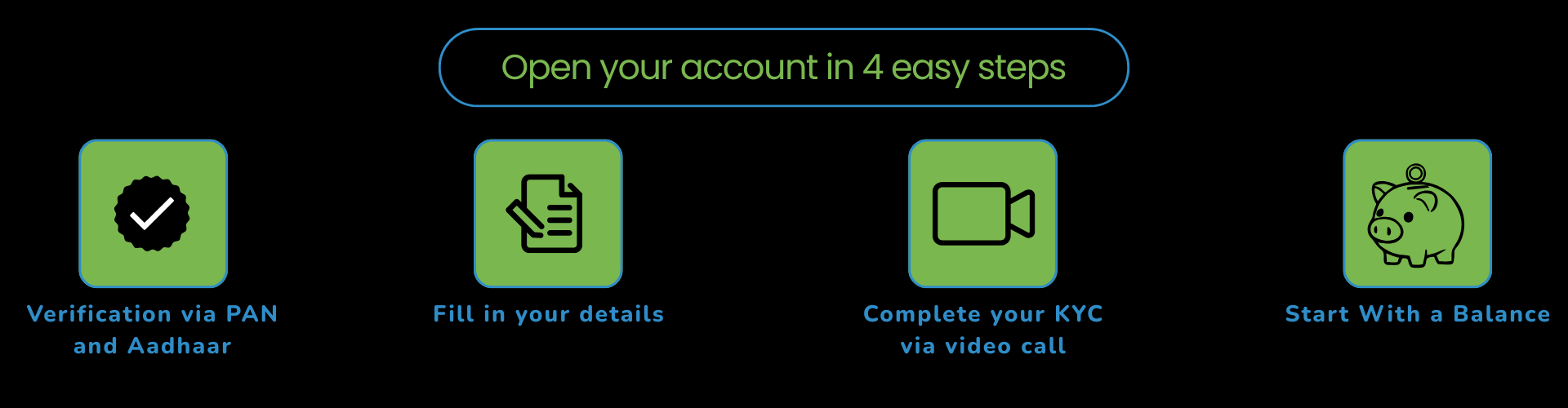

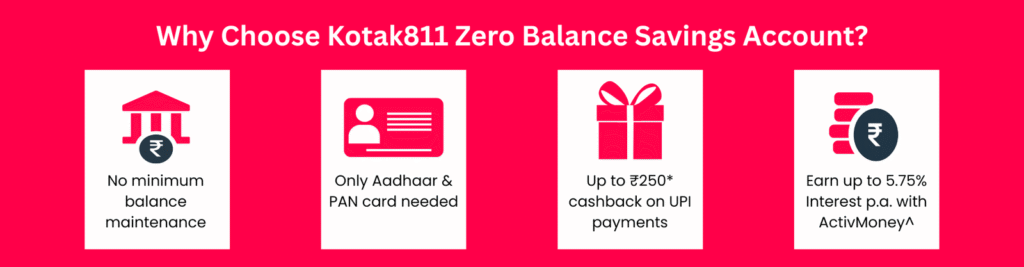

Zero-Balance Digital Savings Account That Fits Right In Your Pocket

Open An Online Savings Account With IndusInd Bank Mobile App

Switch to a better way to bank!

KIWI Credit Card offers a 100% virtual, Lifetime free card with up to 5% cashback, UPI rewards, and airport lounge access. For android users only.

Kiwi Credit Card – Fees & Rewards at a Glance

Eligibility Criteria

Documents Required

Get a lifetime free credit card with ZERO forex markup and unlimited domestic lounge access

Fees & Charges

Key Features

Eligibility

Documents

Photo: Passport-size

Enjoy seamless UPI payments with the convenience of a card, no bank account needed

Smart spending made rewarding, powered by trust and great benefits

Zero joining fee! Save up to 1.5% on bill payments, ₹6,000 annually on UPI transactions, and enjoy up to 10% savings as NeuCoins on Tata brands like BigBasket, 1mg, Croma, TataCliQ, and more via the Tata Neu app.

Fees & Charges : Joining Fee: ₹0

Annual/Renewal Fee: NeuCard Infinity: ₹1,499 + GST (Waived on spending ₹3 lakh or more in the previous year), NeuCard Plus: ₹499 + GST (Waived on spending ₹1 lakh or more in the previous year)

Exclusive Benefits

Up to 10% savings as Tata NeuCoins on purchases from Tata brands, including BigBasket, AirAsia, Tata 1mg, Croma, TataCliQ, Westside, Titan, Tanishq, and more. Applicable for transactions made via the TataNeu app/website and Tata NeuPass registration.

Up to 1.5% savings on all UPI transactions via the Tata Neu App using NeuCard (Maximum ₹500 per month).

Complimentary Airport Lounge Access:

NeuCard Infinity: 12 free visits annually (8 domestic + 4 international).

NeuCard Plus: 4 domestic lounge visits per year.

Additional Perks

1% Fuel Surcharge Waiver at all fuel stations across India for transactions between ₹400 and ₹5,000. (Maximum waiver per statement cycle: ₹250 for NeuCard Plus, ₹500 for NeuCard Infinity).

Revolving Credit Facility at competitive interest rates.

Zero Liability Protection on fraudulent transactions and card loss, provided it’s reported promptly.

Documents Required

Address Proof: Aadhaar, Passport, or Latest Utility Bills.

ID Proof: PAN Card, Voter ID, or Passport.

Income Proof: Bank Statement or Salary Slips.

Eligibility Criteria

Age: 21 – 65 years.

Employment Status: Salaried or Self-Employed.

Minimum Income Requirement:

Salaried: ₹25,000 per month.

Self-Employed: ₹6 lakh per annum.

Rio is your all-in-one payment companion, a lifetime-free credit card that links with UPI, enabling you to scan and pay effortlessly anywhere.

Fees & Charges

Joining Fee (First Year): ₹0

Annual Renewal Fee: ₹0

Key Features

Eligibility

Jupiter Credit Card is a lifetime free 3-in-1 Edge RuPay card offering 2% cashback on shopping, travel, and dining, 0.4% on all other spends, 1% fuel surcharge waiver, 1 complimentary lounge access per quarter, and welcome rewards worth ₹1,000.