IDFC BANK

×

Check your credit card eligibility

Apply smart. Avoid rejection.

Check eligibility in just 30 seconds.

Not sure if you’re eligible?

Check

🔍

Showing all cards

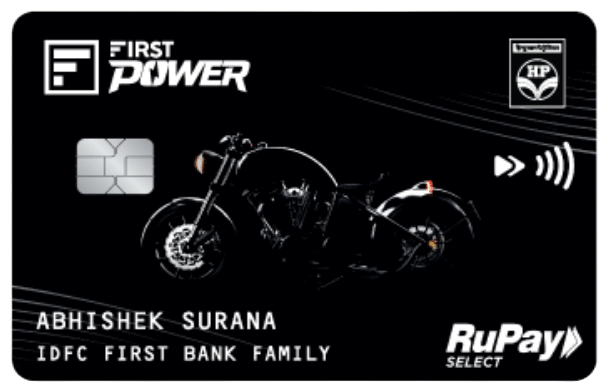

IDFC First Power Credit card

Joining: ₹199 + GST

Annual: ₹199 + GST

- Get ₹250 cashback on first HPCL fuel spend, plus up to 5% total savings on HPCL fuel & LPG when paying via HP Pay.

- Enjoy complimentary roadside assistance (up to 4 times/year) along with ₹2 lakh personal accident cover and lost card protection.

- Save big with up to ₹10,000 off on Apple products, 7.5% off on Croma, and up to 50% discount on rental cars in India and abroad.

×

Eligibility

Documents Required

Fees

IDFC First Power Plus Credit card

Joining: ₹499 + GST

Annual: ₹499 + GST

- Enjoy up to 6.5% total savings on HPCL fuel & LPG, plus ₹500 cashback on your first fuel transaction and interest-free ATM cash withdrawals.

- Earn unlimited reward points that never expire, along with ₹2 lakh personal accident cover, lost card protection, and free roadside assistance (up to 4 times/year).

- Get up to ₹10,000 off on Apple products, 7.5% off on Croma, and up to 50% discounts on domestic & international car rentals.

×

Eligibility

Documents Required

Fees

IDFC SWYP Credit Card

Joining: ₹499 + GST

Annual: ₹499 + GST

- Unlock ₹2,100 EaseMyTrip coupons, 1-year Lenskart Gold, plus up to 3,000 reward points (₹750 value) on early spends and EMI usage.

- Enjoy up to 20–25% discounts on Domino’s, Zomato, Sugar Cosmetics, Paytm Movies, flight & hotel savings on EaseMyTrip, and 4 complimentary railway lounge visits every quarter.

- Get 1% fuel surcharge waiver, free roadside assistance, plus exclusive discounts on Apple, Croma, Flipkart, Myntra, AJIO, Tata CliQ, 1MG, and major travel platforms.

×

Eligibility

Documents Required

Fees

IDFC FIRST WOW Credit Card

Joining: ₹0

Annual: ₹0

- Lifetime free card with no income proof or credit history required—set your own credit limit via fixed deposit and earn 7.5% interest on it.

- EEarn never-expiring reward points, enjoy interest-free ATM cash withdrawal up to 48 days, and spend abroad with zero forex markup.

- GGet up to 50% off on BookMyShow, 20% discounts at 1,500+ restaurants, partner deals on Flipkart, Myntra, AJIO & travel sites, plus ₹2 lakh accident cover and 1% fuel surcharge waiver.

×

Eligibility

Documents Required

Fees

IDFC FIRST Bank Mayura Credit Card

Joining: ₹5999 + GST

Annual: ₹5999 + GST

- Spend globally with 0% forex markup, enjoy domestic & international lounge + spa access (with guest visits), and get trip cancellation cover up to ₹50,000 twice a year.

- Earn up to 12,000 reward points on early spends, plus ₹4,000 cashback on initial transactions—delivering strong value right from day one.

- Enjoy Buy 1 Get 1 movies on BookMyShow, up to 24 complimentary golf lessons annually, and exclusive savings on Apple (up to ₹10,000 + No Cost EMI) and Croma purchases.

×

Eligibility

Documents Required

Fees

IDFC Ashwa Credit Card

Joining: ₹2999 + GST

Annual: ₹2999 + GST

- Enjoy domestic airport spa & lounge visits every quarter, international lounge access, and trip cancellation cover up to ₹25,000 for worry-free travel.

- Earn up to 7,500 reward points on early spends, plus Buy 1 Get 1 movie tickets and up to 24 complimentary golf lessons annually.

- Save big with up to ₹10,000 off + No-Cost EMI on Apple, and exclusive Croma discounts on EMI and non-EMI purchases.

×

Eligibility

Documents Required

Fees

IDFC FIRST Earn Credit Card

Joining: ₹0

Annual: ₹499 + GST

- No joining fee (limited-time)—open an FD from ₹5,000, get a 100% FD-value credit limit, and earn up to 6.30% interest on your deposit.

- Earn up to 1% cashback on UPI spends (higher via IDFC app), plus 10% cashback on your first UPI transaction and rewards on online, utility, insurance, and wallet spends (₹500 cap).

- Get up to 8.5% cashback on travel bookings, 25% off movie tickets, and complimentary roadside assistance for peace of mind.

×

Eligibility

Documents Required

Fees

IndiGo IDFC FIRST Dual Credit Cards

Joining: ₹4999 + GST / 0

Annual: ₹4999 + GST / 0

- Get Mastercard + RuPay cards together with a single application & shared limit—global acceptance, smooth UPI/QR payments, and low 1.49% forex markup for international spends.

- Earn up to 22 BluChips per ₹100 on IndiGo flights, milestone rewards up to 25,000 BluChips annually, plus welcome & renewal vouchers of 5,000 BluChips and meal benefits.

- Enjoy EazyDiner Prime membership, exclusive hotel offers, and big savings on Apple (up to ₹10,000) and Croma (up to ₹7,500) purchases.

×

Eligibility

Documents Required

Fees

IDFC FIRST WOW Black Credit Card

Joining: ₹750 + GST

Annual: ₹750 + GST

- Spend globally with 0% forex markup, enjoy 4 domestic airport lounge visits/year, and earn higher-value reward points on flights & hotels booked via the IDFC FIRST app.

- Earn up to 3X reward points (≈1% value-back) on eligible UPI spends, plus solid rewards on online & offline purchases with travel redemptions at ₹0.50 per point.

- Unlock ₹5,000+ welcome benefits including Lenskart Gold Max & EazyDiner, monthly movie discounts, and a 1% fuel surcharge waiver.

×

2% Cashback on Scan and Pay transactions

2% Cashback on Scan and Pay transactions Age: 25-60 years

Age: 25-60 years ID Proof

ID Proof