- Top credit card from leading banks

- Tech driven process

- Unbiased support

The Smarter Way to Pay!

Jupiter credit card

Jupiter Credit Card is a Lifetime free credit card. 3-in-1 Edge RuPay Credit Card that offers 2% cashback on shopping, travel, or dining and 0.4% cashback on all other UPI and credit card spends. It also provides a 1% fuel surcharge waiver, one complimentary lounge access per quarter, and a welcome reward worth ₹1,000.

Jupiter Credit Card is a Lifetime free credit card. 3-in-1 Edge RuPay Credit Card that offers 2% cashback on shopping, travel, or dining and 0.4% cashback on all other UPI and credit card spends. It also provides a 1% fuel surcharge waiver, one complimentary lounge access per quarter, and a welcome reward worth ₹1,000.

Seamless payment experience

RIO credit card

Rio is your all-in-one payment companion a lifetime-free credit card that links with UPI, enabling you to scan and pay effortlessly anywhere.

Rio is your all-in-one payment companion a lifetime-free credit card that links with UPI, enabling you to scan and pay effortlessly anywhere.

Fees & Charges

Joining Fee (First Year): ₹0

Annual Renewal Fee: ₹0

- The YES Bank Rio RuPay Credit Card is a lifetime free card designed for digitally active users. Earn Rio Coins on every transaction, which can be redeemed as direct cashback to your bank account. Get additional perks like health and wellness offers, making it a valuable card for everyday use.

Key Features

- Rio Coins: Earn on every transaction

- Cashback: 4 Rio Coins = ₹1, directly credited to your account

- Earning Rate: 3 Rio Coins per ₹100 spent via the Rio UPI App

Eligibility

- Age: 21–60 years

- Minimum Income: ₹25,000 monthly (salary) or ₹5 lakh annual ITR (self-employed)

Maximize Rewards on Every Spend with Tata Neu!

Tata neu HDFC bank credit card

Zero joining fee! Save up to 1.5% on bill payments, ₹6,000 annually on UPI transactions, and enjoy up to 10% savings as NeuCoins on Tata brands like BigBasket, 1mg, Croma, TataCliQ, and more via the Tata Neu app.

Zero joining fee! Save up to 1.5% on bill payments, ₹6,000 annually on UPI transactions, and enjoy up to 10% savings as NeuCoins on Tata brands like BigBasket, 1mg, Croma, TataCliQ, and more via the Tata Neu app.

Continue to Tata neuTalk to an expert

Fees & Charges : Joining Fee: ₹0

Annual/Renewal Fee: NeuCard Infinity: ₹1,499 + GST (Waived on spending ₹3 lakh or more in the previous year), NeuCard Plus: ₹499 + GST (Waived on spending ₹1 lakh or more in the previous year)

Exclusive Benefits

Up to 10% savings as Tata NeuCoins on purchases from Tata brands, including BigBasket, AirAsia, Tata 1mg, Croma, TataCliQ, Westside, Titan, Tanishq, and more. Applicable for transactions made via the TataNeu app/website and Tata NeuPass registration.

Up to 1.5% savings on all UPI transactions via the Tata Neu App using NeuCard (Maximum ₹500 per month).

Complimentary Airport Lounge Access:

NeuCard Infinity: 12 free visits annually (8 domestic + 4 international).

NeuCard Plus: 4 domestic lounge visits per year.

Additional Perks

1% Fuel Surcharge Waiver at all fuel stations across India for transactions between ₹400 and ₹5,000. (Maximum waiver per statement cycle: ₹250 for NeuCard Plus, ₹500 for NeuCard Infinity).

Revolving Credit Facility at competitive interest rates.

Zero Liability Protection on fraudulent transactions and card loss, provided it’s reported promptly.

Documents Required

Address Proof: Aadhaar, Passport, or Latest Utility Bills.

ID Proof: PAN Card, Voter ID, or Passport.

Income Proof: Bank Statement or Salary Slips.

Eligibility Criteria

Age: 21 – 65 years.

Employment Status: Salaried or Self-Employed.

Minimum Income Requirement:

Salaried: ₹25,000 per month.

Self-Employed: ₹6 lakh per annum.

The Most Rewarding Lifetime Free Card

Bank of Baroda Credit Card

Smart spending made rewarding – powered by trust and great benefits.

Smart spending made rewarding – powered by trust and great benefits.

Best Travel Card in India!

Federal Bank Scapia Credit Card

Get a lifetime free credit card with zero forex markup and unlimited domestic lounge access.

Get a lifetime free credit card with zero forex markup and unlimited domestic lounge access.

Fees & Charges

Lifetime Free Credit Card

Joining Fee: None

Annual Fee: None

Key Features

Zero forex markup on international spends

Unlock unlimited domestic lounge access + dining, shopping, or spa by spending ₹10,000/month

Earn 20 Scapia Coins/₹100 on travel via Scapia app; 10 Coins/₹100 on most other spends

1% fuel surcharge waiver (up to ₹500/month on spends up to ₹5,000)

Scapia Coins redeemable for 100% value on travel bookings (5 Coins = ₹1)

Eligibility

Age: 23–40 years

Salaried: ₹30,000/month | Self-employed: ₹4L/year

Credit Score: 730+ (Not for new-to-credit applicants)

Documents

ID: PAN/Form 60

Address: Aadhaar, Passport, or utility bill

Income: Bank statement/salary slip

Photo: Passport-size

Best UPI Card for Daily Spends!

Pop UPI Credit Card

Enjoy seamless UPI payments with the convenience of a card – no bank account needed!

Enjoy seamless UPI payments with the convenience of a card – no bank account needed!

Most rewarded UPI virtual card

KIWI Credit card

Kiwi Credit Card offers a 100% virtual, Lifetime free card with up to 5% cashback, UPI rewards, and airport lounge access. For android users only.

Kiwi Credit Card offers a 100% virtual, Lifetime free card with up to 5% cashback, UPI rewards, and airport lounge access. For android users only.

Kiwi Credit Card – Fees & Rewards at a Glance🔹 2% Cashback on Scan and Pay transactions

🔹 0.5% Cashback on online transactions (Excluding rent, fuel, etc.)

🔹 Milestone Rewards of up to 5% cashback

🔹 Earn rewards as ‘Kiwis’, redeemable for instant credit to your Savings Account

🔹 3 Airport Lounge Accesses on spending ₹50K, ₹1L, and ₹1.5L annually

Eligibility Criteria

✔️ Age: 25-60 years

✔️ Salaried Only

✔️ CIBIL Score: 720+

✔️ Minimum Income: ₹1.8L per annum

Documents Required

📌 ID Proof

📌 Income Proof: Last 3 months’ bank statements

📌 PAN Card

RBL Bank Credit Cards

Best for reward redemption & unmatched welcome benefits.

RBL Bank indian oil card

Joining fees - Life time free

Joining fees - Life time free

Annual fees - NO

Fees Waiver - N/A

Offers -

- Earn 20 reward points per ₹100 spent on grocery (1 RP = ₹0.25)

- Discounts on Tata Cliq, Zomato, Swiggy, Zepto and more

- Earn 1 reward point per ₹100 on other purchases

- 10% off on BookMyShow tickets (up to ₹100, 15 times/year)

- Fuel surcharge waiver on ₹500–₹4000 (max ₹100/month)

RBL Bank indian oil xtra credit card

Joining fees - 1500 + GST

Joining fees - 1500 + GST

Annual fees - 1500 +GST

Fees Waiver - Waived on spends above ₹2.75 lakh last year

Offers :

- Get 8.5% savings on fuel spends at Indian Oil outlets

- Earn 3,000 fuel points on your first spend of ₹500 or more

- Collect 2 fuel points for every ₹100 spent on non-fuel purchases

- Earn 15 fuel points per ₹100 at Indian Oil (max 2,000/month)

- Earn 2 fuel points per ₹100 on other spends

- 1 fuel point = ₹0.50 (redeemable at Indian Oil)

- Fuel surcharge waived on ₹500–₹4,000 (max ₹100/month)

RBL Bank Shoprite credit card

Joining fees - Lifetime free

Joining fees - Lifetime free

Annual fees - No

Fees Waiver - N/A

Offers :

20 RP/₹100 on groceries (1 RP = ₹0.25)

Exclusive deals on Tata Cliq, Zomato, Swiggy, Zepto & more

1 RP/₹100 on other spends

10% off on BookMyShow (up to ₹100, 15x/year)

Fuel surcharge waiver on ₹500–₹4,000 (max ₹100/month)

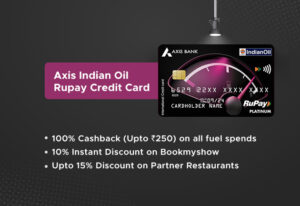

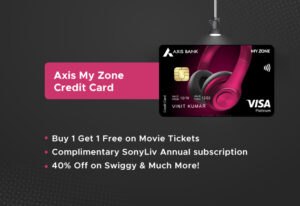

Axis Bank Credit Cards

Most rewarding credit cards

Axis bank indian oil rupay card

Joining fees-500 + GST

Joining fees-500 + GST

Annual fees-500 +GST

Fees Waiver - Waived on spends above ₹2.75 lakh last year

Offers:

- 100% cashback (up to ₹250) on Indian Oil fuel spends within 30 days of activation

- Up to 4% value back at Indian Oil (₹100 = 20 Reward Points, max 1,000/month)

- 10% instant discount on movie tickets via BookMyShow

- Up to 15% off on dining at partner restaurants via EazyDiner

- Reward Points on UPI payments by linking the card

Axis bank Flipkart credit card

Joining fees-Lifetime Free

Joining fees-Lifetime Free

Annual fees- NO

Fees Waiver - NA

Offers:

- ₹600 activation benefits – ₹500 Flipkart voucher + 50% off (up to ₹100) on first Swiggy order

- 5% unlimited cashback on Flipkart (except Health) & Cleartrip spends

- 4% cashback on Swiggy, Uber, PVR, and Cult.fit

- 4 complimentary lounge visits yearly on ₹50,000 spend in the past 3 months

- 15% off (up to ₹500) at 10,000+ restaurants via EazyDiner

HSBC Bank Credit Cards

Global acceptance, rewards, and perks

HSBC Plantinum Credit Card

Joining fees- NIL

Joining fees- NIL

Annual fees- NIL

Fees Waiver- NA

Offers:

- Lifetime free card – No joining or annual fee

- ₹100 Amazon voucher on successful activation

- Earn 2 reward points/₹150 on all spends

- 5X rewards (10 points/₹150) on annual spends above ₹4L (capped at 15,000 bonus points)

- Redeem points for air miles on InterMiles, British Airways, or Singapore Airlines (2 points = 1 mile)

HSBC Live Plus Credit Card

Joining fees- Rs 999 + GST

Joining fees- Rs 999 + GST

Annual fees- Rs 999 + GST

Fees Waiver - On spending Rs 2,00,000 or more in a year

Offer -

- ₹100 Amazon voucher on card activation

- 10% cashback on dining, food delivery & groceries (up to ₹1,000/month)

- 1.5% unlimited cashback on all other retail spends

- ₹1,000 cashback on ₹20,000 spend within 30 days

- 4 complimentary lounge visits per year (1 per quarter)

HDFC Bank Credit Cards

Global acceptance, rewards, and perks

HDFC IRCTC Credit Card

Joining fees- Rs 999 + GST

Joining fees- Rs 999 + GST

Annual fees- Rs 999 + GST

Fees Waiver - On spending Rs 2,00,000 or more in a year

Offer -

- ₹100 Amazon voucher on card activation

- 10% cashback on dining, food delivery & groceries (up to ₹1,000/month)

- 1.5% unlimited cashback on all other retail spends

- ₹1,000 cashback on ₹20,000 spend within 30 days

- 4 complimentary lounge visits per year (1 per quarter)

HDFC Shoppers Stop Credit Card

Joining fees- Rs. 299

Joining fees- Rs. 299

Annual fees- Rs. 299

Fees Waiver - NA

Offer -

- ₹500 Shoppers Stop voucher as a welcome benefit (no min. bill)

- Free First Citizen Silver Edge membership worth ₹350

- 3% rewards on Shoppers Stop spends, 1% on others (monthly caps apply)

- Get ₹2,500 free shopping/year with ₹15,000 weekend spends (max 5x/year)

- Link to UPI and use ‘Scan & Pay’ via RuPay Credit Card

HDFC Millennia Credit Card

Joining fees- Rs. 299

Joining fees- Rs. 299

Annual fees- Rs. 299

Fees Waiver - NA

Offer -

- ₹500 Shoppers Stop voucher as a welcome benefit (no min. bill)

- Free First Citizen Silver Edge membership worth ₹350

- 3% rewards on Shoppers Stop spends, 1% on others (monthly caps apply)

- Get ₹2,500 free shopping/year with ₹15,000 weekend spends (max 5x/year)

- Link to UPI and use ‘Scan & Pay’ via RuPay Credit Card

IndusInd Credit Cards

Luxury, Rewards, Convenience – All-in-One!

IndusInd Bank platinum credit card

Joining fees- NIL

Joining fees- NIL

Annual fees- NIL

Fees Waiver - NA

Offer -

- Lifetime free card – No joining or annual fees

- 1.5 Reward Points/₹150 spent (1 RP = ₹0.65)

- Exclusive discounts on Ajio, Swiggy, PVR, Lifestyle, EazyDiner & more

- 1% fuel surcharge waiver at all petrol pumps across India

- Complimentary ICICI Lombard travel insurance under Platinum Travel Plus

IndusInd legend credit card

Joining fees- NIL

Joining fees- NIL

Annual fees- NIL

Fees Waiver - NA

Offer -

- Lifetime Free Card – No joining or annual fees

- Earn 1 RP/₹100 on weekdays & 2 RP/₹100 on weekends

- Buy 1 Get 1 Free on BookMyShow – Up to 3 free tickets/month

- Bonus 4,000 RPs on annual spend of ₹6L+ & exclusive brand offers (Swiggy, boAt, BigBasket, etc.)

- Low forex markup of 1.8% + complimentary travel insurance

IndusInd RuPay Platinum credit card

Joining fees- NIL

Joining fees- NIL

Annual fees- NIL

Fees Waiver - NA

Offer -

Lifetime Free Credit Card – No joining or annual fees

Earn 2 RPs/₹100 on UPI & 1 RP/₹100 on other spends

1% fuel surcharge waiver on transactions ₹400–₹4,000

Travel insurance worth ₹2.25L with coverage for baggage, passport, and delays

Accepted across UPI platforms for seamless, rewarding payments

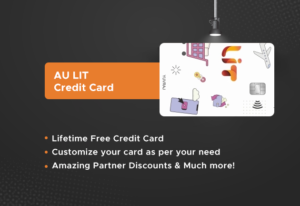

AU Bank Credit Cards

Rewarding benefits, exclusive offers, and seamless transactions.

AU altura Plus credit card

Joining fees- Rs 499 + applicable taxes

Joining fees- Rs 499 + applicable taxes

Annual fees- Rs 499 + applicable taxes

Fees Waiver - NA

Offer -

Get ₹500 voucher on ₹10,000 spend within 60 days + 500 bonus RPs on ₹20,000 monthly spend

1.5% cashback on retail POS spends (max ₹100 per cycle, fuel excluded)

2X reward points on online purchases

2 complimentary railway lounge access/quarter at select stations

1% fuel surcharge waiver + EMI option for spends ₹2,000+

AU LIT credit card

Joining fees- NIL

Joining fees- NIL

Annual fees- NIL

Fees Waiver - NA

Offer -

- Lifetime Free Card – No joining or annual fees

- Customizable benefits – Choose perks like lounge access, boosted rewards, etc., as per your needs

- 5% off at Croma on spends of ₹15,000+ (once/month)

- 15% off on Tata CliQ, EasyDiner, and Cleartrip (monthly limits apply)

- 20% off on movie tickets (up to ₹100/month on ₹500+ spend)

SBI Credit Cards

Exclusive rewards, unbeatable savings, and premium perks!

SBI cashback credit card

Joining fees- Rs 999 + GST

Joining fees- Rs 999 + GST

Annual fees- Rs 999 + GST - Second year onwards

Fees Waiver- Annual Fees will be waived on annual spends of Rs 2 Lacs

Offer -

- Apply for up to 3 Add-on Cards – absolutely free

- 5% cashback on online spends (combined cap ₹5,000/month)

- 1% cashback on offline spends

- 1% fuel surcharge waiver on ₹500–₹3,000 transactions (max ₹100/month)

- All benefits apply per statement cycle for better tracking and value

SBI BPCL credit card

Joining fees- Rs 499 + GST

Joining fees- Rs 499 + GST

Annual fees- Rs 499 + GST from second year onwards

Fees Waiver- NIL

Offer -

2,000 bonus RPs (worth ₹500) on joining fee payment

4.25% value back (13X RPs) on fuel spends at BPCL outlets

1% fuel surcharge waiver on BPCL transactions up to ₹4,000

5X RPs on groceries, movies, dining & departmental stores

10% instant discount during major online sales with SBI Card

SBI simplyCLICK credit card

Joining fees- Rs 499 + GST

Joining fees- Rs 499 + GST

Annual fees- Rs.499 + GST, from second year onwards. Renewal Fee reversed if annual spends for last year >= Rs. 1,00,000

Offer -

- ₹500 Amazon gift card on paying the annual fee (₹499 + taxes)

- 10X reward points on online spends with top brands like Myntra, Swiggy, BMS, Cleartrip, etc.

- 5X reward points on other online spends (up to 10,000 RPs/month)

- Milestone vouchers worth ₹4,000 on ₹1L & ₹2L annual online spends

- 1% fuel surcharge waiver on spends of ₹500–₹3,000 (max ₹100/month)

SBI SimplySAVE credit card

Joining fees- Rs 499

Joining fees- Rs 499

Annual fees- Rs 499 second year onwards

Offer -

- 2,000 bonus reward points on spending ₹2,000 within 60 days

- 10X reward points on dining, movies, groceries & departmental store spends

- ₹100 cashback on 1st ATM withdrawal within 30 days of card setup

- Annual fee waiver on annual spends above ₹1 lakh

- 1% fuel surcharge waiver on spends between ₹500–₹3,000 (max ₹100/month)

SBI miles credit card

Annual Fee (one-time): Rs 1499 + GST

Renewal Fee (per annum): Rs 1499 + GST

Offer -

- ₹1,500 Travel Credits on spending ₹30,000 within 60 days

- Earn Travel Credits – 2/₹200 on travel spends & 1/₹200 on others

- Redeem credits on flights, hotels, catalog & air miles

- 5000 bonus credits on annual spends of ₹5 lakh

- Annual fee waiver on spends of ₹6 lakh + 1% fuel surcharge waiver

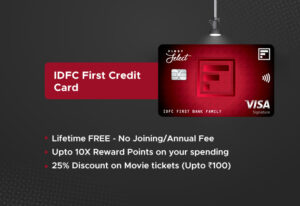

IDFC Bank Credit Cards

IDFC Credit Cards – Rewards That Never Expire!

IDFC SWYP credit card

Joining Fees: Rs 499 + GST

Annual Fees: Rs 499 + GST (2nd year onwards)

Offer:

- ₹2,100 EaseMyTrip coupons on joining

- 1-year Lenskart Gold Membership complimentary

- 1,000 Reward Points on 1st EMI within 30 days

- 2,000 Reward Points on ₹5,000+ spend in first 30 days

- 20% off on Dominos (up to ₹80) twice/month on ₹299+ orders

IDFC FIRST power plus credit card

Joining Fees: Rs 499 + GST

Annual Fees: Rs 499 + GST

Fees waiver: Avail annual fee waiver on spends over Rs 150000

Offer:

Save up to 6.5% on HPCL fuel spends (up to ₹35,000/month)

Interest-free ATM withdrawals

Earn 3X Rewards on retail spends

Save up to 5% on grocery & utility bills

Get 25% off (up to ₹100) on movie tickets monthly

ICICI Bank Credit Card

iCICI bank credit card

Joining Fees: Lifetime Free (Depending upon the card selected)

Annual Fees: Lifetime Free (Depending upon the card selected)

Offer:

- Lifetime FREE – No joining or annual fee on select ICICI credit cards

- Exclusive Discounts during Amazon & Flipkart online sales

- Earn 2 Reward Points per ₹100 on retail spends (excluding fuel)

- 1 Reward Point per ₹100 on utility & insurance payments

- Special deals on brands like MakeMyTrip, Haier, McDonald's & more