- Save upto 30% on limited premium.

- ZERO cost term insurance.

- Lifetime insurance coverage

Insufficient Life Cover Can Shatter Dreams !

Are You Really sufficient Covered?

Get 1cr. life cover @ ₹522*/month

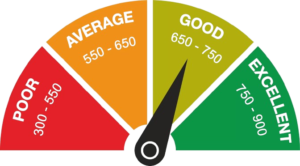

Speak to an expertFinance calculatorA sufficient life cover is typically 10–20 times your annual income, helping your family manage expenses, debts, and future goals in your absence. However, the ideal coverage varies for each individual based on age, income, and existing liabilities such as loans and EMIs. Always plan according to your personal financial needs.

Yes, it’s possible to increase your term insurance coverage during the policy term. This can be done through riders or policy modification, depending on the insurer. Note that an increase in coverage may involve underwriting, especially if your health has changed since the original policy purchase.

Before buying a term plan, check the coverage amount, policy term, and premiums to ensure affordability. Verify the insurer’s claim settlement ratio for reliability, and explore available add-ons or riders. Understand exclusions and renewal terms to avoid surprises. Ensure the plan aligns with your long-term financial goals.

Don’t let market ups and downs affect your child’s dreams

Get guranteed returns upto 6.4%

- 100% Tax free returns

- Life insurance cover include

- Customize PPT & PT

- Loan against policy available

It’s a financial plan that offers assured returns on your investment along with optional life cover. The returns are fixed and known at the time of purchase, making it ideal for risk-free goal planning.

Yes, the returns are fixed and not linked to the market. They are backed by the financial institution offering the product and comply with regulatory norms.

Returns usually range between 5% to 6.5% (IRR), depending on the premium amount, payment term, and payout structure. A customized benefit illustration will show exact figures.

Yes. Premiums may qualify for deductions under Section 80C, and maturity proceeds can be tax-free under Section 10(10D), subject to conditions and prevailing tax laws.

Yes, there is typically a 2-5-year lock-in period depending upon PPT & PT. Early surrender may reduce the payout depending on how long the policy was active.

Ensure a worry-free retirement with a reliable pension plan.

Wealthy retirement

Many worry about not starting their pension savings early- Lifetime guaranteed income

- Inflation- beating income.

- Immediate income starts

- Get higher interest on defferd income

Reduce risk, boost confidence—guaranteed returns help you create a healthier portfolio. Speak to our financial expert today. Schedule a call back now!"

Get in touch with us